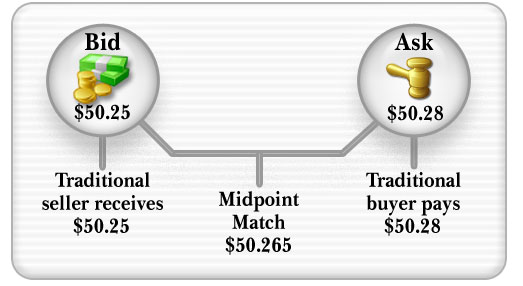

The International Securities Exchange (ISE) Stock Exchange, LLC offers its Midpoint Match facility that allows US stock traders and investors to buy or sell at the average of the bid and ask price instead of having to buy at a higher ask price and sell at a lower bid price. This unique matching platform furthers the quest of professional traders and investors to minimize their trading costs. Customers choosing IB SmartRoutingSM will automatically be able to take advantage of Midpoint Match as an additional routing destination for price improvement.

is eliminated, and the buyer and seller would each save $0.015 per share.

- Continuous, instantaneous, and fully automated

- Complete anonymity

- Minimizes market impact

- No restrictions on maximum trade size

- No pre-set timed crossing

- NYSE, NASD, and AMEX stocks and ETFs available

- Access to non-displayed liquidity

- Two types of orders; Standard and Solicitation of Interest (SOI)

With IB SmartRoutingSM

The IB SmartRouter probes the ISE Stock Exchange for available price improvement.

The IB SmartRouter will determine if a marketable order will be routed to ISE,

or to a conventional exchange/ECN, based on order and market information, including:

- Size of the order relative to the NBBO size

- Price of the order relative to the NBBO price

- NBBO width

With ISE Stock Exchange Directed Orders

Both ISE Midpoint Match order types, Standard and Solicitation of Interest (SOI)

are supported by IB:

- Standard orders are non-displayed and can be entered as market or limit orders. Market orders execute at the NBBO midpoint whenever there is an eligible contra-order. Limit orders only execute whenever the available midpoint price is better than the limit price.

- SOI orders are fill requests broadcast to ISE Midpoint Match users. SOIs have the advantage of a higher execution priority against any incoming orders, but must have a minimum quantity of 2,000 shares. These orders may not be cancelled for several seconds while the ISE solicits interest.

- No odd lots will be accepted for either order type.

- Market orders and limit orders may be denominated in penny increments, with executions occurring in whole cent increments, or 1/2 cent increments whenever a 1/2 cent increment is the midpoint. The Midpoint Match facility does not support executions below $1 per share.

- Native Immediate-or-Cancel (IOC) orders are also supported for both Standard and SOI orders.

| Quick Links † | |

|

|

| † Link names are the navigation sequence through the IB website menu bar located at the top of every IB web page. | |