Option Analytics

See how price and volatility changes affect an option's value and risk dimensions.

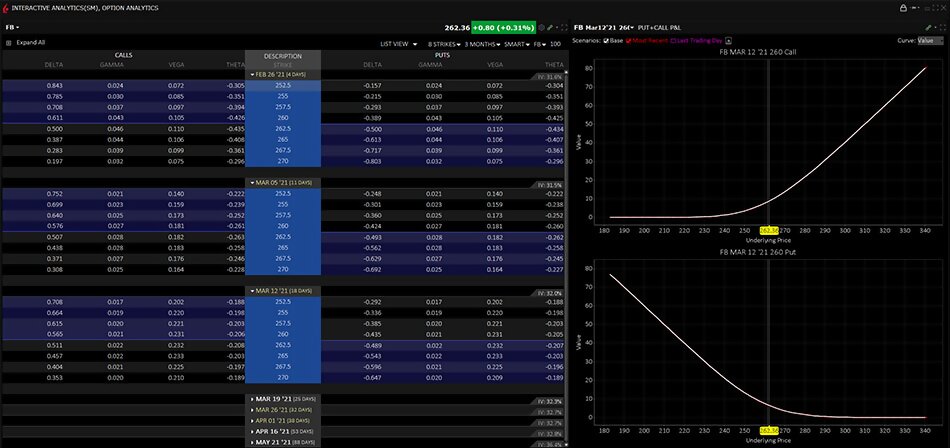

Part of our Price/Risk analytics suite, the Option Analytics Window lets option traders visualize changes in an option's price with respect to unit changes in Greek values.

The Option Analytics Window includes the following features:

- Create interactive curves to see at a glance how changing volatility assumptions, stepping closer to expiration and adjusting the price of the underlying impacts the value of an option line.

- Specify close values by increasing or decreasing the implied volatility, and reducing the time to expiry.

- Create dynamic curves based on different date scenarios.

- Modify the strike prices, expiries and exchanges using easily accessible controls.

- View Greeks and Put+Call P&L curves together or separately.

USER GUIDES

Get Started with Option Analytics

For more information on Option Analytics, select your trading platform.

Disclosures

- Any symbols displayed are for illustrative purposes only and do not portray a recommendation.

- Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking here.

- Interactive Brokers LLC is a member of NYSE, FINRA, SIPC