Interactive Brokers Home

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

#1 Best Online Broker

5 out of 5 stars

Best for

Advanced Traders

Best Online Broker

Experience Professional Pricing

- Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

- IBKR BestXSM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while minimizing market impact.

- Margin rates up to 29% lower than the industry.3

- Earn interest rates of up to USD 3.14% on instantly available cash.4

- Earn extra income on your lendable shares.

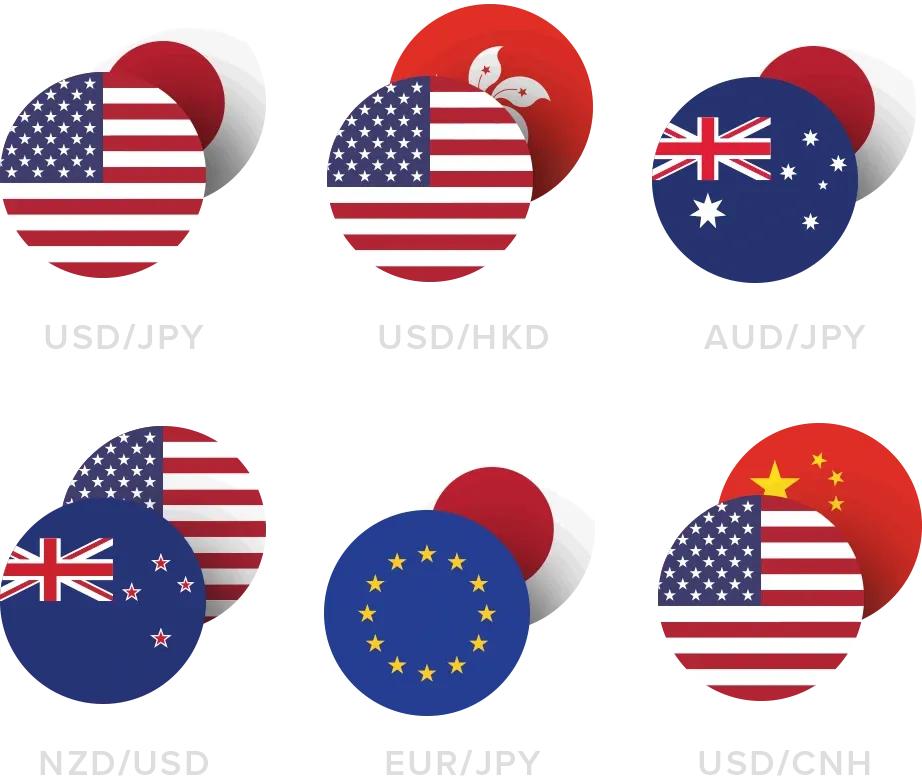

Discover a World of Opportunities

Invest globally in stocks, options, futures, currencies and bonds from a single unified platform. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

160

Markets

37

Countries

28

Currencies*

Global Markets

Available currencies vary by Interactive Brokers affiliate.

Graphic is for illustrative purposes only and should not be relied upon for investment decisions.

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

Discover new investment opportunities with over 200 free and premium research and news providers.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types - from limit orders to complex algorithmic trading - help you execute any trading strategy.

Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times in the broader financial markets. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR from major market events that can threaten the stability of financial institutions.

Member of the

S&P 500

Nasdaq Listed: IBKR

$19.5B

Equity Capital*

74%

Privately Held*

$13.3B

Excess Regulatory Capital*

4.13M

Client Accounts*

3.62M

Daily Avg Revenue Trades*

IBKR Protection

Interactive Brokers Group and its affiliates. For additional information view our Investor Relations - Earnings Release section.

Choose the Best Account Type for You

Step 1

Complete the Application

It only takes a few minutes

Step 2

Fund Your Account

Connect your bank or

transfer an account

Step 3

Get Started Trading

Take your investing to

the next level

Interactive Brokers Australia Pty Ltd (ABN 98 166 929 568) holds an Australian financial services licence, no. 453554, and is a participant of the markets operated by ASX, ASX 24 and Cboe Australia and of the clearing facilities operated by ASX Clear and ASX Clear (Futures). Our registered Office is located at Level 11, 175 Pitt Street, Sydney, New South Wales 2000, Australia

Interactive Brokers Australia does not provide financial product advice. The information available on this website has been provided for information and educational purposes only and has been prepared without considering your objectives, financial situations or needs. The information on this website should not be treated as advice or relied upon in substitution for independent financial advice.

Trading and investing in financial products carries significant risks and may not be suitable for all persons. You may lose all of the money you invest. Trading in derivatives or with any other form of leverage (margin), may result in losses surpassing your original investment or deposit. You should ensure you fully understand and accept the risks of trading and investing in light of your objectives, financial situations and needs before doing so. You should also ensure that you understand specifications that apply to any particular products you wish to invest in before doing so. We recommend you seek independent financial or taxation advice prior to trading and investing.

If available, it is important that you read and understand any Product Disclosure Statements ('PDS') provided by us before you decide whether or not to acquire any of the financial products to which the PDS relate. You should also ensure you acquire and read our Financial Services Guide ('FSG') and understand our legal terms before opening an account with Interactive Brokers Australia.

The information on this website about Interactive Brokers Australia and the products and services we offer may be accessed worldwide but is not intended for use by persons who are located in any place where, or to any person whom, such use would not be lawful according to the laws of that particular place.

Interactive Brokers Australia and its affiliates use cookies. Your use of our website and websites operated by our affiliates indicates your agreement to our, and our affiliates, use of cookies in accordance with our privacy policy.

- According to StockBrokers.com Interactive Brokers Review: Read the full article Online Broker Reviews, January 29, 2025. "Interactive Brokers continues to lead with unbeatable margin rates, a significant advantage for active and professional traders." View our margin rates for more information.

- Annual Percentage Rate (APR) on AUD margin loan balances as of August 29, 2025. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Learn more about margin loan rates.

- Interactive Brokers Group and its affiliates. For additional information view our Investor Relations - Earnings Release section.

- Interactive Brokers LLC rating by Standard & Poor's. View report

- For complete information, see our margin rate comparison.

- Restrictions apply. See additional information on interest rates. Credit interest rate as of December 12, 2025.

- Available currencies vary by Interactive Brokers affiliate.

Individual Accounts

Individual Accounts Joint Accounts

Joint Accounts Retirement Accounts

Retirement Accounts Trust Accounts

Trust Accounts Family Advisor

Family Advisor Institutional Accounts

Institutional Accounts