Margin Trading

What is Margin Trading?

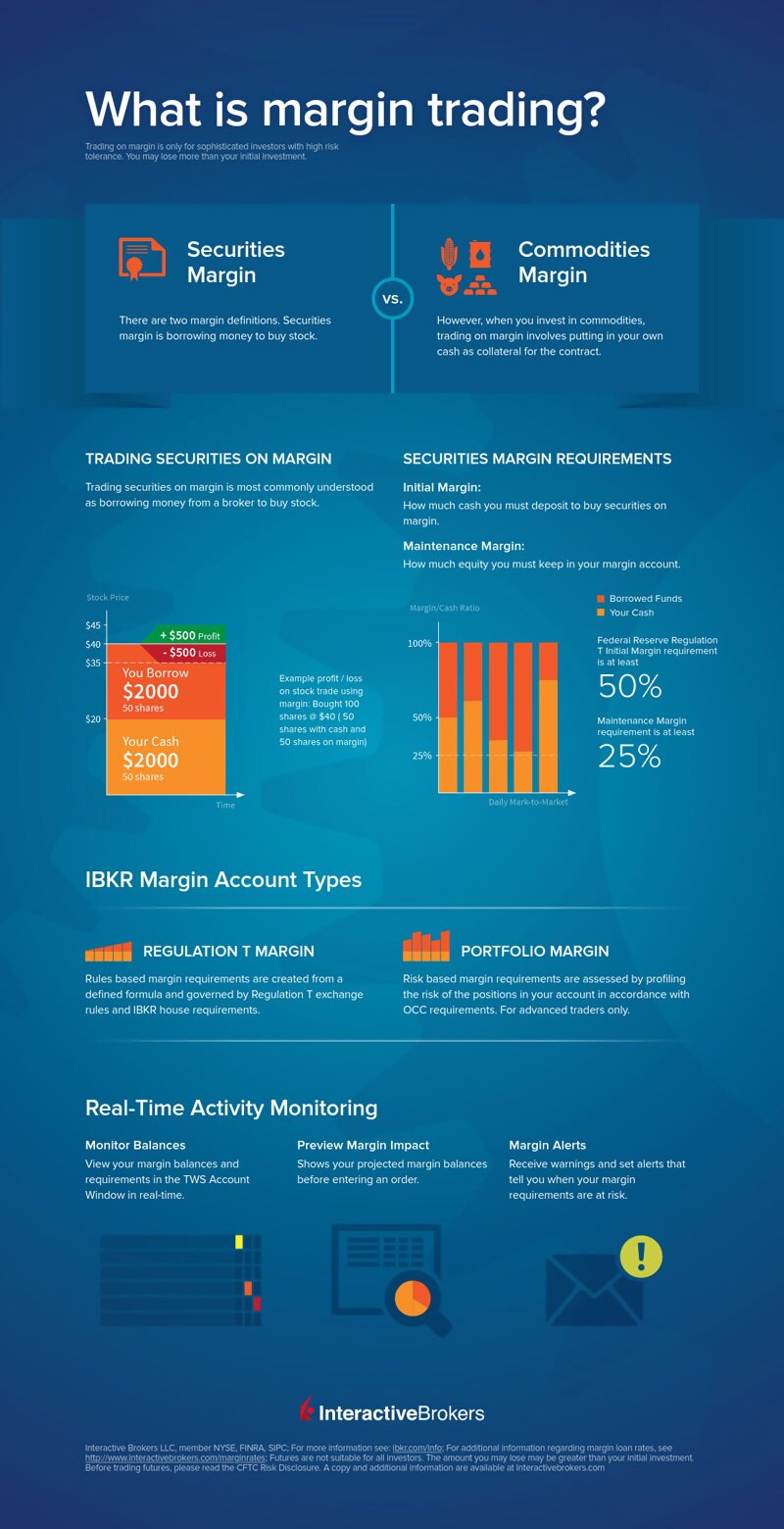

There are two margin definitions. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your own cash as collateral for the contract.

View InfographicBenefits of a Margin Trading Account

Use the cash or securities in your brokerage account as leverage to increase your buying power.

Get the lowest market margin loan interest rates of any broker.1

Diversify trading strategies with short selling, options and futures contracts, or currency trading.

Borrow against a margin account at any time and repay the loan on your own schedule.

Understand the Risks of Margin Trading

Margin borrowing is only for experienced investors with high risk tolerance.

You may lose more than your initial investment.

Before trading on margin, understand the following risks

- Trading losses may be greater than the value of the initial investment

- Leveraged investments create a greater potential risk of loss

- Additional costs from margin interest charges

- Potential margin calls or liquidation of securities

How Trading Securities on Margin Works

Rules-based vs. Risk-based Margin

Margin models determine the type of brokerage accounts you open and the type of financial instruments you may trade. Trading on margin uses two key methodologies: rules-based and risk-based margin.

- In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. This is the more common type of margin strategy used by securities traders.

- In risk-based margin systems, margin calculations are based on the risk inherent in your trading portfolio. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements.

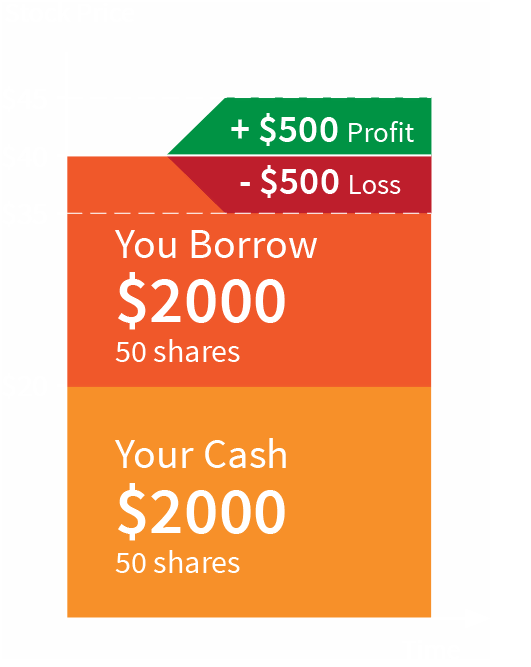

shares @ $40 (50 shares with cash and 50 shares on margin)

IBKR Clients Have Access to the Lowest Margin Rates1

Rated Lowest Margin Rates1 by StockBrokers.com

AUD Margin Loan Rates Comparison2

| AUD 50K | AUD 100K | AUD 250K | AUD 500K | |

|---|---|---|---|---|

| Interactive Brokers (No Surcharge)3,4,5 | 5.273% | 5.273% | 5.073% | 4.923% |

| Interactive Brokers (Surcharge)3,5,6 | 6.273% | 6.273% | 6.073% | 5.923% |

| Westpac Online | 7.600% | 7.600% | 7.600% | 7.600% |

| NABTrade | 8.500% | 8.500% | 8.250% | 8.150% |

| St.George Bank | 9.580% | 9.580% | 9.330% | 9.080% |

| Bell Direct | 9.150% | 9.150% | 9.150% | 9.150% |

| Webull | 9.600% | 9.600% | 9.600% | 9.600% |

Each firm's information reflects the standard online margin loan rates obtained from their respective websites. Competitor rates and offers subject to change without notice. Services vary by firm.

Other currency margin loans available at comparably low rates.

View Margin Rate DetailsNotes:

- According to StockBrokers.com Interactive Brokers Review: Read the full article Online Broker Reviews, January 29, 2025. "Interactive Brokers continues to lead with unbeatable margin rates, a significant advantage for active and professional traders."

- Annual Percentage Rate (APR) on AUD margin loan balances as of August 29, 2025. IBKR calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Rates subject to change. For additional information on margin loan rates, visit our website.

- IBKR calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. For additional information, visit our website. Under some commission plans, overnight carrying fees may apply.

- The standard rate (i.e. without IBAU surcharge) applies for non-retail (wholesale or professional investor) clients of IBKR Australia, excluding non-retail natural person clients of IBKR Australia (wholesale or professional investor) with a Standard Margin Lending Facility.

- IBAU customers are only able to hold and borrow supported currencies. Foreign exchange conversion fees will apply to convert margin loan balances drawn down for purchases denominated in unsupported currencies. Visit our Knowledge Base for more information.

- For all retail clients of IBKR Australia and non-retail (wholesale or professional investor) natural person clients of IBKR Australia with a Standard Margin Lending Facility), an additional spread ("IBAU Surcharge") will be added to the standard rates in all tiers. The IBAU Surcharge is currently 1% for borrows in AUD and 2% on all other borrowings. Visit our Knowledge Base for more information on margin accounts under IBKR Australia, as well as our Knowledge Base for more information on regulatory status under IBKR Australia.

Margin Education Course on Traders' Academy

Introduction to Margin Trading

This course is designed to help investors understand margin basics, including different types of margin accounts, margining methods, and margin requirements, plus how to monitor margin on both Trader Workstation (TWS) and IBKR Mobile.

Trading on margin is only for sophisticated traders. You may lose more than your initial investment.

- Introduction to Margin

- Monitoring Margin in TWS

- Looking at Margin on IBKR Mobile

Start trading and investing like a professional today!

Open AccountDisclosures

- According to StockBrokers.com Interactive Brokers Review: Read the full article Online Broker Reviews, January 29, 2025. "Interactive Brokers continues to lead with unbeatable margin rates, a significant advantage for active and professional traders."