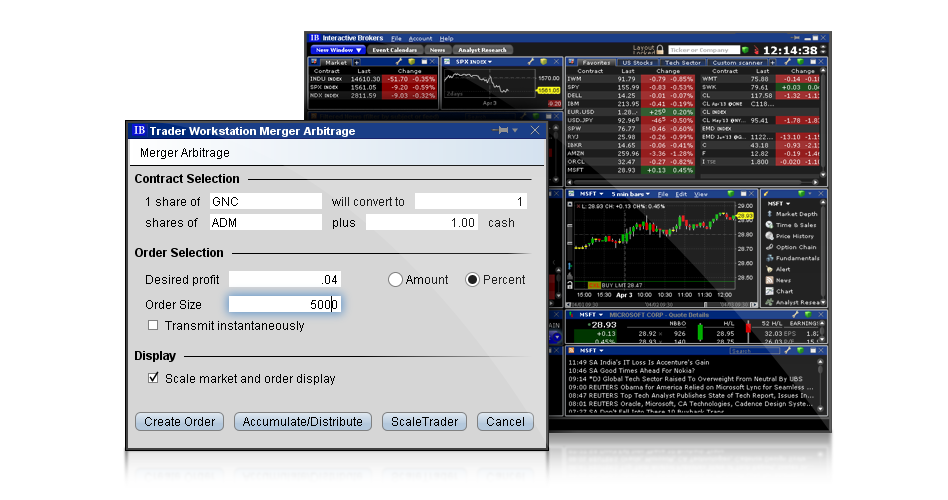

Take advantage of Trader Workstation's Merger Arbitrage tool,

which lets you trade stocks when a merger or acquisition offer is announced.

TWS Merger Arbitrage supports the following types

of mergers and acquisitions:

- A cash merger, where an acquirer proposes to purchase the shares of the target for a certain price in cash.

- A stock-for-stock merger, where the acquirer proposes to buy the target by exchanging its own stock for the stock of the target.

TWS Merger Arbitrage offers traders

the following benefits:

- Quickly and easily create a combination order for an anticipated merger between two companies from a single window.

- Create the order on a Quote Monitor, or manage the order in a more sophisticated TWS trading tool, such as Accumulate/Distribute or ScaleTrader.

- Scale the market data to display the price of the combination per share of the company being acquired.